what is a closed tax lot report

The business is closed and you are ready to. Scroll down to the section Sale of Asset enter the sales price or if it was not sold enter -1 The above steps causes those assets highlighted to appear on form 4797 and boom bada bing.

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position.

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

. A wash sale loss on a trade is a deferred loss. A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices and you enter a trade to sell only part. So far the Tax Planner Cap Gains screen Cap Gains Report and Schedule D.

That deferred loss is ADDED to the. Our tax opinion letter helped him a lot. In general each tax lot will have a different purchase price.

Other names for unclaimed property are escheat or abandoned property. For example Box 9 is 1234 and box 11 is 1234. A section 1256 contract does not include any contract or option on.

Closed period reports show data up to the closed accounting period date with any adjustments automatically pushed into the subsequent period. 60 of the gain or loss is taxed at the long-term capital tax rates. Unclaimed property is not a tax.

As a result of IRS cost-basis reporting regulations that took effect at the beginning of 2011 the adjusted cost basis for some of your tax lots may be reported to the IRS while the adjusted cost basis for other tax lots will not depending on the. You can also view whether your positions are categorized as long term or short term. The Realized GainLoss tab lets you filter for a specific time period and displays sells and corporate action events such as mergers and spin-offs see figure 2.

Report on Form 1099-B the relevant information about the security sold to open the short sale with the exceptions described in the following paragraphs. Unclaimed property is funds andor property that are in the possession of a holder that are owned by or owed to someone else. Gainloss information is not provided for transactions that Fidelity is not required to report on Form 1099-B such as transfers to other accounts.

Each purchase represents a unique tax lot so you could have multiple tax. File a final Form 1099-B for the year the short sale is closed as described above but do not include the 2021 tax withheld on that Form 1099-B. As Wells Fargo Advisors is not a legal or tax advisor we encourage you to speak to your chosen tax.

If available gainloss information is provided for closed lots that require 1099-B reporting. It shows wash sale information and any adjustments to cost basis when applicable. 33498 39848 - 1922 x 2 69452.

According to Taxes and Investing the money received from selling a covered call is not included in income at the time the call is sold. Tax Lot Accounting. Client received a 1099B for a regulated futures contract with only box 9 and box 11 completed other than box 1a description.

With these three reporting modes a. 1001 considers transactions concluded on the sale date and the amount realized includes the expected fair value of all assets received including contingent consideration. A tax-lot relief method is used to determine which lots of a security are liquidated first in a given sales transaction.

Tax treatment of covered calls. That makes me wonder whether this is more of a queryreport issue rather than the actual lot tables getting corrupted with incorrectly closed lots. Discuss tax lot relief methods and your tax lot relief strategy with your advisors.

Income or loss is recognized when the call is closed either by expiring worthless by being closed with a closing purchase transaction or by being assigned. The taxation of options contracts on exchange traded funds ETF that hold section 1256 assets is not always clear. Under the closed transaction approach Sec.

In the Contracts Straddles 6781 section I put box 11 in section 1256 contracts gain loss and. Your capital gain or loss is equal to the difference between the assets cost basis and the sales price of the closing transaction. A tax lot is the number of shares in the same security acquired at the same time.

4 I had reached out to Payroll for clarification about reporting compensation from Lot 1 and Lot 2 on my paychecks and also on w-2 Box 1 but NOT reporting anything for Lot 3. Section 1256 options are always taxed as follows. Not sure if that matters but thought of mentioning it.

In box 1a report the quantity of the security delivered to close the short sale. Leave the other numbered boxes blank. 40 of the gain or loss is taxed at the short-term capital tax rates.

Since it is not a tax there is no statute of limitations for unclaimed property unless a state enacts. Make a list of questions you have about cost basis reporting. This was NOT mentioned against Lot3.

Box 9 is positive and box 11 is the same number only negative. Assuming this is all the activity in these particular puts that you engaged in in 2015 then your overall loss is. In box 1b report the acquisition date of the security delivered to close the short sale.

And finally incremental reports compare the data from two points in time and display the changes made between those report dates. A record keeping technique that traces the dates of purchase and sale cost basis and transaction size for each security in your portfolio even if you make more than one. It mentioned that Tax lot closed is a specified lot.

In box 1a enter a brief description of the transaction for example 5000 short sale of 100 shares of ABC stock not closed. Holding period is traced by tax lot and cost basis is generally tracked by tax lot. Proposed Regs 11256-1a state.

A6mD8d could you confirm that. In turn it helps identify the cost basis and holding period of the asset sold. This tax savings relates directly to the deferral period ie the length of time of the contingency and the sellers marginal tax rate.

Enter the date the business closed if known otherwise enter 1231 of the tax year you are preparing. A tax lot is a record of the date quantity and cost of a purchase or opening transaction short sale. Although neglected upkeep may be the most visible sign of vacancy and one that is likely to result in a code violation property tax delinquency Alexander and Powell find is the most significant common denominator among vacant and abandoned properties 41 When an owner stops paying property taxes local governments initiate a.

How To Use A Profit Loss Report To Increase Your Income Bookkeeping Business Small Business Bookkeeping Business Tax

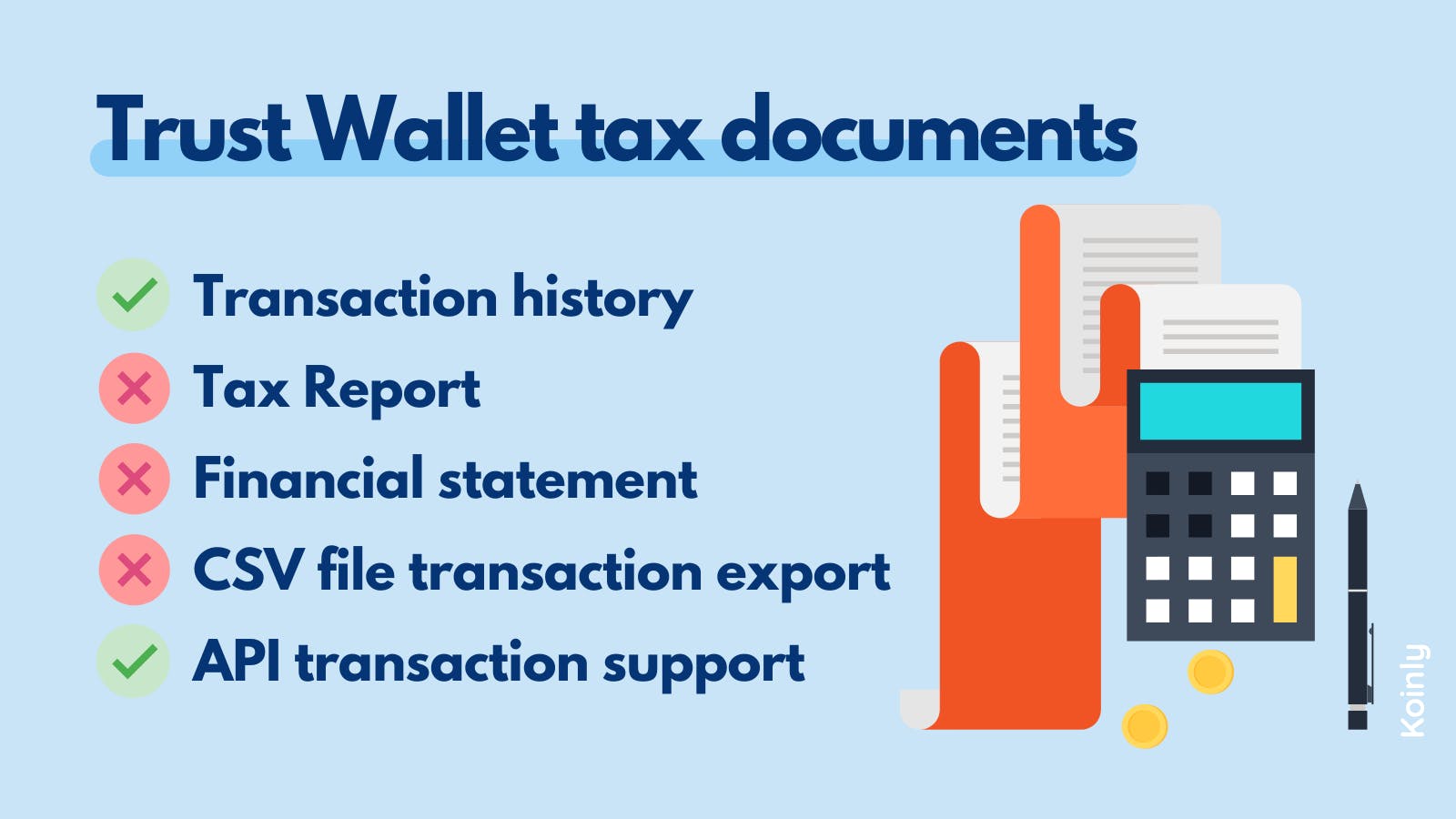

How To Do Your Trust Wallet Taxes Koinly

Guide To Shortlist A Comprehensive Accounting Service Company Accounting Services Bookkeeping Services Accounting Firms

Ecosia S Financial Reports And Tree Planting Receipts Trees To Plant Financial Investing

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

How To Do Your Trust Wallet Taxes Koinly

Definition What Is A Tax Return Tax Return Tax Services Tax

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Tax Time Word Search Puzzle Word Search Puzzle Free Word Search Puzzles Word Search Games

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

A Beginner S Guide To A Profit And Loss Report

The Ultimate Voyager Tax Reporting Guide Koinly

Watch Out For These Tax Taxes Tax Credits Income Tax Tax

Service Tax Report With Money And Tax Money Report

Uber Tax Filing Information Alvia Filing Taxes Tax Uber

5 Investment Tax Mistakes To Avoid Tax Mistakes Investing Tax Preparation